- Hired to work in Kolkata.

- Has worked for Tata Steel

- selling Tata’s Chrome ore to China

- sold 2.5 million mt of Chrome concentrate from India to China.

- total China import was 20 million mt.

- Had discussions with him after he retires from Tata

- Tata were selling high Ferrous Mn ore

- competing with Million Link products.

- Tata one of the biggest Iron ore miner.

- Anthony

- Sunil Jha

- he has worked for big steel companies.

- has worked for Ferroalloy purchasing.

- maybe if he can bring some new models that we haven’t been using.

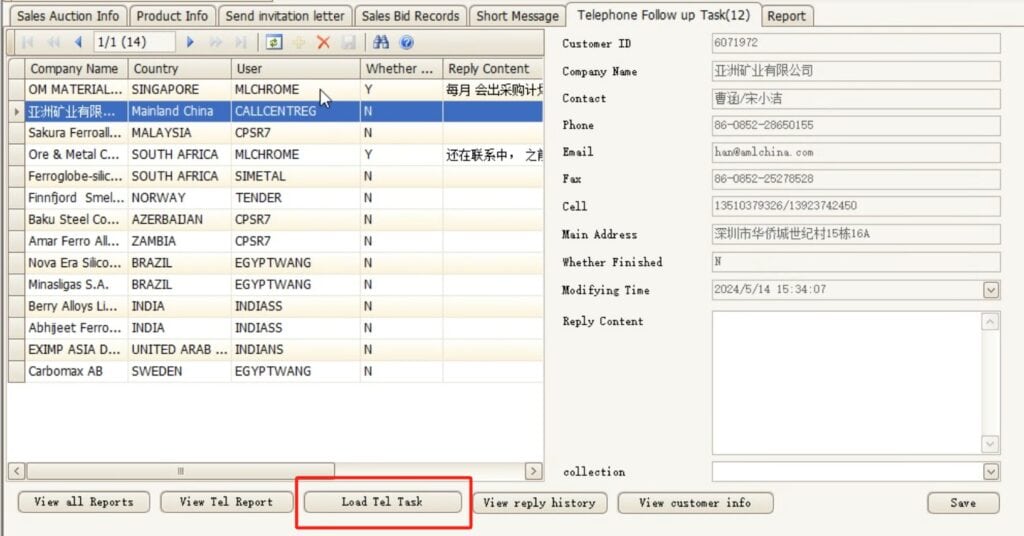

- try to find out the business models with big companies.

- most of our business has been inquiry & offers.

- if there is another business model to do business with big steel plants.

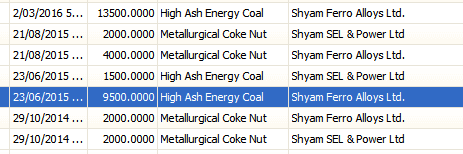

- we had long term purchase contracts with india ferroalloy plants

- some of these projects failed.

- how does Tata do their purchasing.

- can we try this model too.

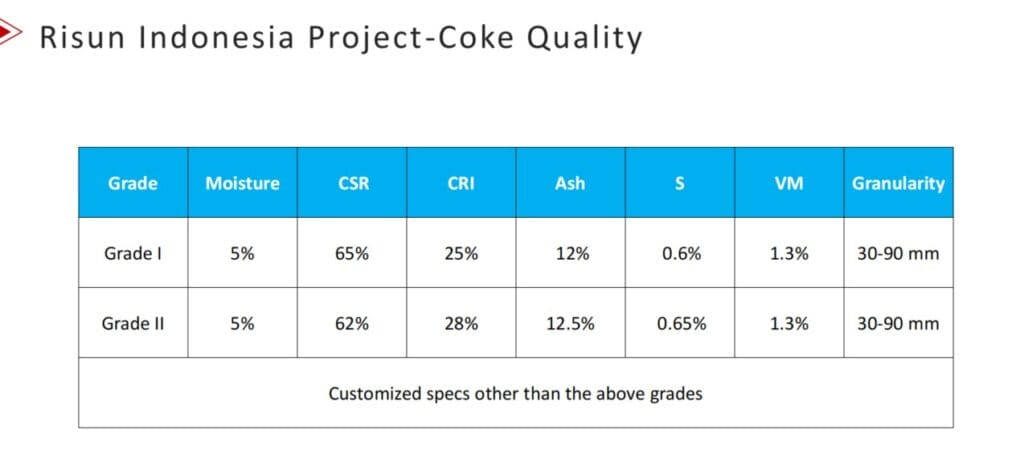

- Coke sales model.

- possible to expand to Indian steel plants.

- India is producing coke locally (from Australia/local coking coal)

- Chinese coke still has a chance.

- Luna

- Background of Mr Sunil

- our weakness is on long term contracts.

- if he has experience in big companies and producers.

- want to learn from his experience for FeCr to China.

- we bought FeCr from India to China, but we don’t have competitive edge.

- Anthracite

- our supplier is not very reliable.

- we need to establish a qualified supplier.

- promote this product to indian market.

- Chinese Ferraolloys

- export to india.

- we need to register as a supplier at an Indian steel plant.

- EMM

- FeSi

- Neha

- will welcome the new India ideas.

- no development on Steel plants.

- eg EMM sold to JSW? – small qty

- we couldn’t get long term business.

- encourage the new products to the company.

- Coke 25 – 80mm (bigger size)

- Anthracite

- Carlos offers … due to high freight.

- offers not competitive

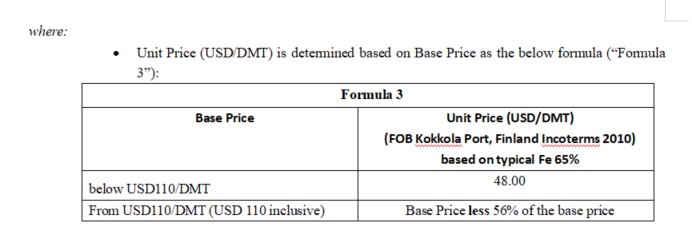

- Iron ore from Finland.

- promoted to Rashmi.

- waiting for auction from Odessa mines.

- CV of Sunil Jha

- Role / Job Description

- What will be his job/role in Million Link

- Employee Induction.

- how to bring him on board efficiently.

- how would the traders like to collaborate with him

- Documentary Secretary

- who will be his document secretary?

- He has experience

- Mn ore

- Chrome ore

- Iron ore?

- Will have his own Serviced office in Kolkata.

- will either have Seema as assistant

- or somebody else.

- His role in MILLION Link

- won’t work with Mn ore from Gabon

- work as an advisor for Million Link

- help to restart Chrome ore/FeCr business.

- India doesn’t export anymore.

- Job title :

- work for foreign business fields

- met coke

- supply to India.

- blast furnace coke.

- register Million Link with the Steel plants.

- Met Coke will be his main role.

- Finland Iron Ore.

- Rashmi – Neha responsible.

- Sunil responsible for developing with other companies.

- Steel companies always link with each other.

- Iron ore.

- knowledge in iron ore is extensive.

- developing Iron ore market from India.

- We want to strengthen our sales

- Met coke

- currently doing Breeze

- want to do BF Coke

- we aren’t doing any business from Scratch.

- any purchase person we hire

- that person needs to do business together with the other traders.

- the new person will help to do bigger and better.

- Management

- Million Link has a unique management model

- we won’t use Sunil Jha as a higher manager

- will report to the board of directors.

- will not report to Anthony or Neha directly.

- Sales role

- Sunil’s role is for sales & procurement

- BF coke may take time to succeed.

- we have given him 6 months for onboarding.

- his main income will come from business success.

- Contract start 3rd June (Monday)

- Office

- will be his own independent office in Kolkata.

- will have his own secretary

- need to spend time with Neha & her customers?

Training Required

- Communication between traders.

- how to prepare resources for the traders.

- what can he can do for the Million Link traders

- what does he require from Million Link

- Need feedback from Million Link traders as to how best he can help them.

CV Sunil Jha

Head-Ferro Alloys (Sales & Conversion) – Ferro Alloys and Minerals

Division at Tata Steel

India

Summary

Experienced leader with thirty plus (30+) years of diversified experience in functional areas of Ferro Alloys and Minerals Business with extensive knowledge in handling key bulk commodities like Iron Ore, Manganese Ore, Chrome Ore, Coal, Coke and Ferro Alloys.

Proven track record in sales, business development and leadership roles within India as well as international markets with experience in independently running a Trading Company overseas – have four years stint of Heading Tata Steel Asia (Hong Kong) Ltd based out of Hong Kong.

Passionate about driving growth and delivering results in dynamic, competitive landscapes.

Experience

Tata Steel Ltd

- Head-Ferro Alloys (Sales & Conversion) – Ferro Alloys and Minerals Division

- July 2019 – March 2024 (4 years 9 months)

- Kolkata, West Bengal, India

- As the Head of Sales and Conversion activities for the Ferro Alloys and Minerals business of Tata Steel responsible for sales Ferro Alloys and Minerals (Manganese, Chrome, Coal/Coke) in India.

- Managed the unique model of tolling (conversion) for production of Refined/Bulk Manganese Alloys and Coke.

- Further developed system processes and customer base for the sales of Iron Ore and Low-Grade Manganese Ore along with scaling up the business to a consistent level.

Tata Steel Asia (Hong Kong) Limited

- General Manager

- November 2015 – June 2019 (3 years 8 months)

- Hong Kong

- Headed Tata Steel Asia (Hong Kong) Ltd as the General Manager overseeing all aspects of company operations, with a focus on business development and marketing of Ferro Alloys, minerals and other bulk commodities across China, Far East, and South East Asian countries.

- Trusted with the responsibility for achieving top line growth, managing P&L, ensuring full compliance with statutory regulations for an overseas company, and reporting directly to the Board of Directors.

- Was pivotal in exponential growth ~2X growth of the organization during my tenure.

Tata Steel

- 24 years 5 months

- Sr Manager – Exports

- 2007 – November 2015 (8 years)

- Responsible for Marketing and Sales of Ferro Alloys, Chrome Ore and Iron Ore in International market from booking to shipment including documentation, other back-end activities related to it.

- Established Mn Alloys Export business in International market under challenging conditions with major Steel mills of the world including JFE (Japan), POSCO (Korea) besides Tata Steel Thailand, NatSteel Singapore, etc.

- Manager

- July 1991 – June 2007 (16 years)

- Various locations in India.

- Various roles as per organisational need in Marketing & Sales, HR,

- Commercial, Sourcing, Contracting for facilitating port related activities, etc for export/ international sales.

- Onida Branch Manager

- November 1987 – July 1991 (3 years 9 months)

- Various locations across India

- Marketing and Sales of ONIDA brand electronics and consumer durables such as TV, Audios, Washing machine, Air Conditioners, etc.

Education

- Magadh University (LNM Institute, Patna), India.

- Master of Business Administration – MBA · (1987)

- LNM Institute, Patna, India.

- Post Graduate Diploma in Personnel Management & Industrial Relations. · (1985)

- Ranchi University (Cooperative college, Jamshedpur)

- Bachelor of Arts – BA Honours, Economics · (1984)

- Loyola School Jamshedpur

- ICSE, High School · (1979)